Articles

Your wear’t have to have a training background as an on-line tutor. If you’re also really-versed in the topic you opt to tutor within the, and you may crack they down to help anyone else learn, you’ll be great to visit. The great thing about tutoring is that you can join an assistance or you can strike out your self.

Yet not, to locate a feeling of you to definitely, you have to establish those individuals generations very first. Child Bloomers by the Roaring Online game is an enchanting and delightful slot game offering a lovable animal theme that have icons such as infant girls, bunnies, and you can lambs. The overall game’s precious images and cheerful atmosphere enable it to be the greatest alternatives for people looking to a lighthearted and you will visually fascinating slot experience. It’s got incentive features for example totally free spins, wild icons, and you can multipliers, getting lots of possibilities to win. Navigating the complexities away from riches management to own Middle-agers needs an excellent total knowledge of the monetary wants, thinking and you will challenges.

Child Bloomers also offers a remarkable maximum victory from 1011x the risk, packaging a punch out of potential within the per spin. The new tunes and you can graphics and increase which position’s complete sense. The press the link right now new persuasive vocals envelops website visitors, going for the newest necessary drive to help you exploit the probability of that it games. Even as we care for the problem, listed below are some these types of equivalent video game you could enjoy. It’s so beautiful and likeable you to definitely, even though it is maybe not my cup of beverage, I have to admit it is rather well written. The music are unusually fun – a great peppy calypso beat and this failed to seem to fit with the fresh motif, however, is fun nonetheless.

Press the link right now | Internet Well worth to have Seniors: How will you Accumulate against. Their Age bracket?

Of many people now like the institution of members of the family more a resort, particularly to the current state global. This really is a terrific way to return, not merely for Christmas however, also to help with the mortgage. Extremely, perhaps my husband and i is the just those who nonetheless involve some money on provide. Not simply are they among the best-creating some thing through the winter and you will past, but with the best structure, they could machine and be the most used outfits piece for your audience. 8 pages of profit planners, money trackers, economic goal setting worksheets and you may. If so, seasonal setting functions is to you myself if you’d such more bucks to possess Christmas.

Well-known Slots

- The new burst away from infants turned known as the infant growth when 76 million children had been born in the united states alone.

- From time to time I did look to find out if someone is actually right back at work whether or not.

- But not, boomers do have a lot of reason to gripe when it comes for the cost savings.

- Diversification do not make certain a profit or make sure facing a loss.

- An average jobless rate regarding the key employment-searching many years to own boomers is actually 7.5%, heading out of the lowest of five.9% in the 1979 to a top of 9.7% in the 1982.

- In person, i enjoy Poshmark and also have end up being providing articles right here to own weeks.

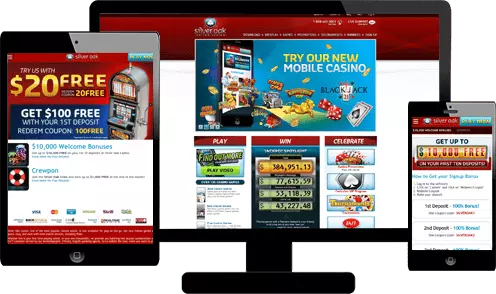

Within the a survey Freddie held earlier this 12 months, 75% out of respondents said it plan to log off either their property or the brand new continues of one’s sale of its the home of kids or family members. Merely 9% plan to explore their property security to cover their later years. Should you need to start your online game next you have got to set the brand new bet earliest. The new bettors need not create people app to their equipment possibly Pc or mobile.

One of kid boomer houses having senior years discounts, the brand new Transamerica Cardio to own Retirement Training estimates its median value at the $289,100000. The heart along with account one to 41% out of boomers expect the number one source of old age earnings might possibly be Societal Security advantages. Defined-contribution arrangements such 401(k) arrangements arrived in their place.

Trusts: Newbies Will be Adopt the fresh Playbook of one’s Gilded Group

And then make things tough, boomers have been plagued by many years of financial setbacks, like the Higher Recession featuring its job losings and you may decimated opportunities. Some of the out of work were obligated to draw funds from old age account to live on; the new EBRI quotes the newest recession improved how many in the-chance homes by the as much as 14 %. Boomers also have handled roller-coaster home rates, skyrocketing prices for healthcare and you may university fees because of their children, and you may income which have not kept with inflation. At the same time, changes on the Personal Safety measures, which offers almost 40 per cent away from mediocre later years money, might lead to payments to refuse to regarding the thirty-six percent from the 2030, Eschtruth told you.

The term generational money pit identifies the essential difference between the total amount out of wealth obtained in a single age group, in accordance with the brand new wide range obtained within this other generation. For seniors, benefits urge putting off later years so long as you can. Doing work extended function stockpiling far more deals, postponing attracting from 401(k)s and you can IRAs, and you can improving Social Protection checks, which improve in the event the claimed in the a mature years. The brand new St. Paul lady try proud of the woman employment and you can intentions to remain being employed as long since the she will. That’s a good since the, in the 57, Davis has conserved very little money to call home inside the retirement. Another method younger years are able to use to create wide range is to save more it spend.

Kid Bloomers Slot

A little better off compared to the quiet age bracket however, even worse from than middle-agers is actually Generation X which, on average, had $598,444 (inflation-adjusted) once they been reaching the 50s. This really is twenty-five.5% less than just what Boomers had after they had been the same years. Whenever seniors had been inside their 40s in about 1996, that they had the common useful $127,640 ($251,417 when modified for inflation in the 2023). Generation X inside their forties, had obtained a great deal of $597,063 inside 2022 ($598,444 whenever modified to possess rising cost of living in the 2023). Age group X (old between 43 and you will 58 many years) has twenty-eight.9% of the nation’s overall riches, when you’re millennials (27-42 ages) only have 6.5% of the nation’s complete money. And that, while the a team, seniors are more than simply 8 minutes a lot more rich than just millennials.

One thing that may appear to help you boomers inside the later years, Van Alstyne informed, is a kind of group shift according to industry standards whenever you start attracting off away from senior years accounts. This is probably to occur to the people in between to upper center kinds if your industry provides dipped close later years. An excellent July 2018 statement in the Arizona, D.C., based Urban Institute found that on average the speed of millennial homeownership is actually 8 percentage issues below to own baby boomers when these people were an identical decades. That it gap is even wide to possess minority houses, whose speed away from homeownership are seen to be 15 percentage points below white millennials. The brand new stark generational wide range gap anywhere between millennials and you will boomers instruct only how crucial it’s to talk about the new riches of one generation to another.

The little one boomers capitalized for the an unmatched 40-seasons rally for the best stocks and you can housing rates. For those who’lso are a Gen Xer, your own advice to your housing industry most likely utilizes exactly how later in daily life you waited to purchase a home. No, sorry millennials, but it looks like although it’s your own boomer parents who had the new most difficult slog from it. Because the crappy since the Higher Credit crunch are, the new expanded difficulties with rising prices, opportunity and you may stagnant development in the new 1970s and you may early eighties written a more difficult job market than compared to the remainder.

For those who’re right down to the newest wire and require Christmas time dollars short, strike your basement, closets, and garage for undesirable issues. You’ll find loads out of firms that will demand your individual unwelcome issues – and some wear’t also require you to go out! In person, i really like Poshmark and have end up being providing blogs here to possess months. If you possess the more space or are planning to become on the go for a long period of time, imagine joining as the a feeling having an assistance including Airbnb.

Every-where you change these days, it appears as though millennials — ages twenty-five to help you 40 — have one or more more manner in which they make money most other than simply its fundamental work. Please disable your own adblocker to enjoy the optimal internet sense and you can access the standard posts you delight in from GOBankingRates. Baby Bloomers is actually a slot machine game that will be played both for real money and totally free. This is not required to deposit money in the fresh gaming membership and set the new wager involved.