You need enough money to cover your expensesuntil you get your next paycheck. Once you receive that paycheck,you can repay the lender the amount you borrowed, plus a littleextra for the lender’s assistance. In Notes Receivable, we were the ones providing funds that we would receive at maturity.

Written by True Tamplin, BSc, CEPF®

By contrast, recording liabilities in accounts payable doesn’t always take interest into account, nor does it involve formal promissory notes. Instead, you simply enter each individual item on the liability side of the balance sheet. When you take out a loan, it’s important to manage your payments carefully. Any business loan payments and outstanding amounts should be marked on the balance sheet as part of the notes payable account.

3.1 Short-Term Note Payable

Here’s a closer look at what the notes payable account is, and what function it serves in business accounting. As previously discussed, the difference between a short-term note and a long-term note is the length of time to maturity. Also, the process to issue a long-term note is more formal, and involves approval by the board of directors and the creation of legal documents that outline the rights and obligations of both parties. These include the interest rate, property pledged as security, payment terms, due dates, and any restrictive covenants. Restrictive covenants are any quantifiable measures that are given minimum threshold values that the borrower must maintain.

- Whenever a business borrows money from any lender, it must be reported in the notes payable account.

- But you must also work out the interest percentage after making a payment, recording this figure in the interest expense and interest payable accounts.

- Since they’re not written agreements, the terms can be changed on the agreement between the vendor and the business entity.

- This is because the debit side indicates no further liability for the borrower with the cash account being credited.

- Sierra borrows $150,000 from the bank on October 1, with payment due within three months (December 31), at a 12% annual interest rate.

- The note in Case 2 is drawn for $5,200, but the interest element is not stated separately.

- Accounts Payable decreases (debit) and Short-Term Notes Payable increases (credit) for the original amount owed of $12,000.

Journal Entry to Record Equipment Purchased and Issuance of Notes Payable

This note represents the principal amount of money that a lender lends to the borrower and on which the interest is to be accrued using the stated rate of interest. The notes payable are not issued to general public or traded in the market like bonds, shares or notes payable journal entry other trading securities. They are bilateral agreements between issuing company and a financial institution or a trading partner. Notes payable is an instrument to extend loans or to avail fresh credit in the company. In this journal entry, both total assets and total liabilities on the balance sheet of the company ABC increase by $100,000 as at October 1, 2020. This journal entry is made to eliminate (or reduce) the legal obligation that occurred when the company received the borrowed money after signing the note agreement to borrow money from the creditor.

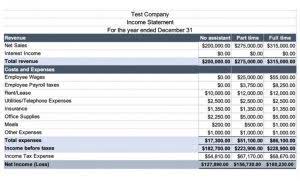

We now consider two short-term notes payable situations; one is created by a purchase, and the other is created by a loan. There is an ebb and flow to business that can sometimes produce this same situation, where business expenses temporarily exceed revenues. Even if a company finds itself in this situation, bills still need to be paid. The company may consider a short-term note payable to cover the difference. In the above example, the principal amount of the note payable was 15,000, and interest at 8% was payable in addition for the term of the notes.

Borrowers should be careful to understand the full economics of any agreement, https://www.bookstime.com/bookkeeping-services and lenders should understand the laws that define fair practices. Lenders who overcharge interest or violate laws can find themselves legally losing the right to collect amounts loaned. You’ve already made your original entries and are ready to pay the loan back. Recording these entries in your books helps ensure your books are balanced until you pay off the liability. In the second case, the firm receives the same $5,000, but the note is written for $5,200.

- On November 1, 2018, National Company obtains a loan of $100,000 from City Bank by signing a $102,250, 3 month, zero-interest-bearing note.

- As a result, any notes payable with greater than one year to maturity are to be classified as long-term notes and require the use of present values to estimate their fair value at the time of issuance.

- The principal is repaid annually over the life of the loan rather than all on the maturity date.

- This is a contra-liability account and is offset against the Notes Payable account on the balance sheet.

- These require users to share information like the loan amount, interest rate, and payment schedule.

At some point or another, you may turn to a lender to borrow funds and need to eventually repay them. Learn all about notes payable in accounting and recording notes payable in your business’s books. One problem with issuing notes payable is that it gives the company more debt than they can handle, and this typically leads to bankruptcy. Issuing too many notes payable will also harm the organization’s credit rating. Another problem with issuing a note payable is it increases the organization’s fixed expenses, and this leads to increased difficulty of planning for future expenditures. In this case the note payable is issued to replace an https://x.com/BooksTimeInc amount due to a supplier currently shown as accounts payable, so no cash is involved.