Additionally, you should recalculate your predetermined overhead rate any time there is a significant change in your business, such as the addition of new equipment or a change in your product line. Here’s how a service-based business, namely a marketing agency, might go about calculating its predetermined overhead rate. Again, that means this business will incur $8 of overhead costs for every hour of activity. That means this business will incur $10 of overhead costs for every hour of activity. The production hasn’t taken place and is completely based on forecasts or previous accounting records, and the actual overheads incurred could turn out to be way different than the estimate. Sourcetable, an AI-powered spreadsheet, streamlines complex calculations, empowering you to focus on results rather than processes.

Accounting Jobs of the Future: How Staffing Agencies Can Help Land Them

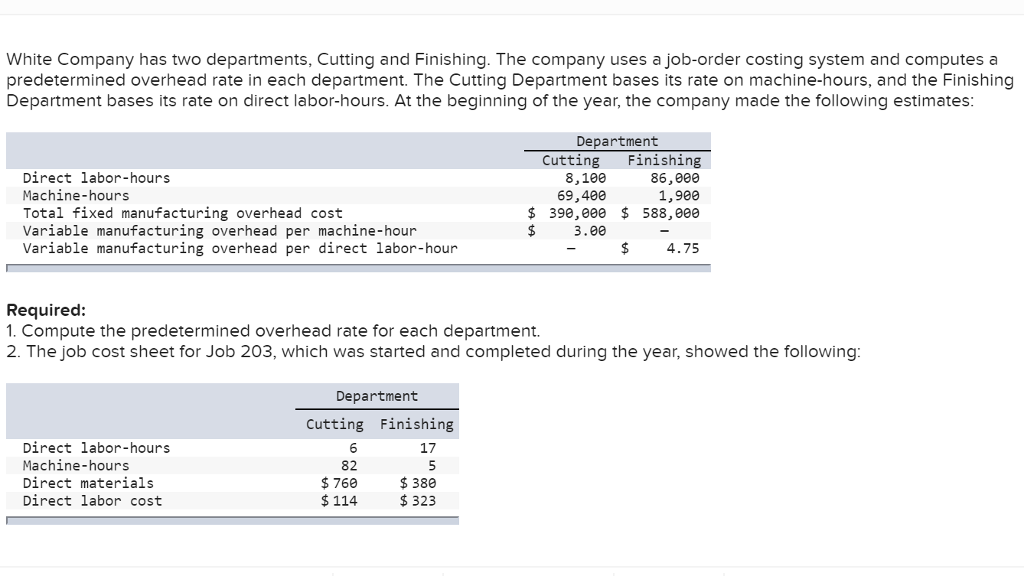

Overhead costs are those expenses that cannot be directly attached to a specific product, service, or process. Allocation bases (such as direct labor, direct materials, machine how to calculate predetermined overhead rate hours, etc.) are used when finding a relationship with total overhead costs. To calculate the predetermined overhead, the company would determine what the allocation base is.

How do I know if a cost is overhead or not?

Larger organizations employ different allocation bases for determining the predetermined overhead rate in each production department. These overhead costs involve the manufacturing of a product such as facility utilities, facility maintenance, equipment, supplies, and labor costs. Whereas, the activity base used for the predetermined overhead rate calculation is usually machine hours, direct labor hours, or direct labor costs.

Problems with Predetermined Overhead Rates

If you’d like to learn more about calculating rates, check out our in-depth interview with Madison Boehm. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Discover the top 5 best practices for successful accounting talent offshoring. Learn about emerging trends and how staffing agencies can help you secure top accounting jobs of the future. See the top eBay selling tools available today to help ecommerce companies more effectively scale or run their business on eBay.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Built-in analytics help uncover spending trends and quickly flag unusual variances for further investigation.

- Allocating overhead this way provides better visibility into how much overhead each department truly consumes.

- To calculate their rate, the marketing agency will need to add up all of its estimated overhead costs for the upcoming year.

- Allocation bases are known amounts that are measured when completing a process, such as labor hours, materials used, machine hours, or energy use.

- Setting accurate predetermined overhead rates aids in better product costing and efficiency in financial operations, ensuring that all production costs are accounted for systematically.

For this, you can take the average manufacturing overhead cost for the previous three months, and divide this by the machine hours in the current month. If you then find out later that in fact the actual amount that should have been assigned is $36,000 dollars, then the $4000 dollar difference should be charged to the cost of goods sold. The concept is much easier to understand with an example of predetermined overhead rate. For instance, imagine that your company has a new job coming up, and you need to calculate predetermined overhead rate for an estimate of manufacturing costs.

Direct Costs Versus Indirect Costs

The predetermined overhead rate is crucial for accurate cost accounting and efficient management of production costs. Using the predetermined overhead rate aids in developing comprehensive budgets and setting financial benchmarks. It plays a crucial role in financial management by enabling the projection and control of overhead costs in production settings. Predetermining is a process of working out the predetermined overhead rate by dividing the estimated amount of overhead by the estimated value of the base before actual production commences.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Furthermore, historical data is not always the best for predicting, estimating, and forecasting. Obotu has 2+years of professional experience in the business and finance sector.

Predetermined overhead rates are essential to understand for ecommerce businesses as they can be used to price products or services more accurately. They can also be used to track the financial performance of a business over time. The predetermined overhead rate is used to price new products and to calculate variances in overhead costs. Variances can be calculated for actual versus budgeted or forecasted results.

The predetermined overhead rate, also known as the plant-wide overhead rate, is used to estimate future manufacturing costs. So in summary, the overhead rate formula relates your indirect operating costs to production costs. The most important step in calculating your predetermined overhead rate is to accurately estimate your overhead costs. A predetermined overhead rate is an allocation rate given for indirect manufacturing costs that are involved in the production of a product (or several products).