Both closing entries are acceptable and both result in the same outcome. All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet. Closing all temporary accounts to the retained earnings account is faster than using the income summary account method because it saves a step. There is no need to close temporary accounts to another temporary account (income summary account) in order to then close that again. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company.

What is the purpose of the Income Summary account?

The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year? You have also not incurred any expenses yet for rent,electricity, cancelled debt cable, internet, gas or food. This means that thecurrent balance of these accounts is zero, because they were closedon December 31, 2018, to complete the annual accounting period. In this chapter, we complete the final steps (steps 8 and 9) ofthe accounting cycle, the closing process.

Closing Entry in Accounting: Definition, Example, and Best Practices

Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period. In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example. When moving towards a more sophisticated close process, often teams start reconciling the accounts that are most important for their businesses and then expand over time. After these entries, all temporary accounts (revenue, expenses, dividends) will have zero balances, and the net income and dividends will be reflected in the Retained Earnings account.

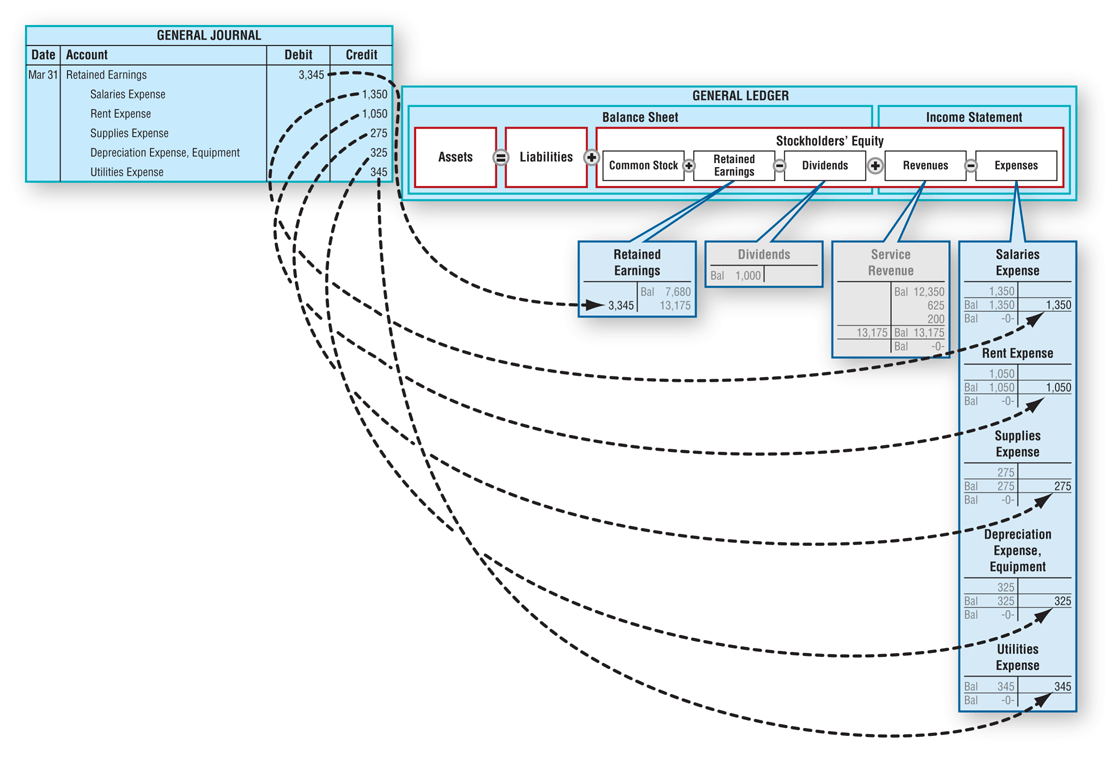

- Notice that the balances in the expense accounts are now zeroand are ready to accumulate expenses in the next period.

- Whether you credit or debit your income summary account will depend on whether your revenue is more than your expenses.

- The balance of the Income Summary account is transferred to the Retained Earnings account.

- Whenyou compare the retained earnings ledger (T-account) to thestatement of retained earnings, the figures must match.

- Nigel Sapp is a content marketer at Numeric, partnering with top accountants to break down best practices, thorny accounting topics, and helping teams navigate the world of accounting tech.

- A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months.

The Most Important Financial Reports for Small Businesses

Now that all the temporary accounts are closed, the income summary account should have a balance equal to the net income shown on Paul’s income statement. Now Paul must close the income summary account to retained earnings in the next step of the closing entries. Temporary accounts, also known as nominal accounts, are accounts that track financial transactions and activities over a specific accounting period. These accounts are “temporary” because they start each accounting period with a zero balance and are used to accumulate data for that period only. At the end of the accounting period, the balances in these accounts are transferred to permanent accounts, resetting the temporary accounts to zero for the next period.

The Income Summary Account

We could do this, but by having the Income Summaryaccount, you get a balance for net income a second time. This givesyou the balance to compare to the income statement, and allows youto double check that all income statement accounts are closed andhave correct amounts. If you put the revenues and expenses directlyinto retained earnings, you will not see that check figure. Nomatter which way you choose to close, the same final balance is inretained earnings. We see from the adjusted trial balance that our revenue accounts have a credit balance.

Step 3: Clear the balance in the income summary account to retained earnings

Once all the adjusting entries are made the temporary accounts reflect the correct entries for revenue, expenses, and dividends for the accounting year. We can also see that the debit equals credit; hence, it adheres to the accounting principle of double-entry accounting. For example, closing an income summary involves transferring its balance to retained earnings. This crucial step ensures that financial records are accurate and up-to-date for the next period, making it easier to track the company’s performance over time. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data. After this closing entry has been posted, each of these revenue accounts has a zero balance, whereas the Income Summary has a credit balance of $7,400.

Take, for example, three common accounting procedures — revenue recognition, fixed asset depreciation, and software capitalization. In the most ideal close, teams would accomplish all of these tasks but that’s rarely the case. Similarly, while textbooks might say that teams should account for every single transaction in a month, that’s also far from reality.

If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry. You must debit your revenue accounts to decrease it, which means you must also credit your income summary account. ‘Retained earnings‘ account is credited to record the closing entry for income summary.

As you will see later, Income Summary is eventually closed to capital. Educate team members about the closing process while also encouraging them to learn from each cycle. Share insights and tips within the team to foster a culture of ongoing improvement. Regular training sessions ensure everyone is on the same page and can adapt to any process changes or new software tools.