Figure 10.18 shows the gross margin resulting from the LIFOperpetual cost allocations of $7,380. Figure 10.16 shows the gross margin, resulting from the FIFOperpetual cost allocations of $7,200. Figure 10.14 shows the gross margin, resulting from thespecific identification perpetual cost allocations of $7,260. Let’s return to The Spy Who Loves You Corporation data todemonstrate the four cost allocation methods, assuming inventory isupdated on an ongoing basis in a perpetual system. Suppose it’s impossible or impractical for a company to understand the impact of switching from FIFO to LIFO. In that case, they need to include a disclosure in their current period financials and apply this method to periods moving forward.

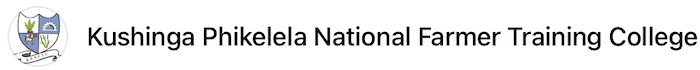

Periodic FIFO Method Example

- Suppose the number of units from the most recent purchase been lower, say 20 units.

- Perpetual inventory allows for more real-time inventory tracking, making it superior to other methods.

- The weighted average method weighs the average cost of Inventory, over the period.

- The accounting period can be in months, quarters or a calendar year.

- The FIFO method avoids obsolescence by selling the oldest inventory items first and maintaining the newest items in inventory.

- Once the period is complete, the company adds the purchase account totals to the inventory’s beginning balance.

This means that the cheapest items in stock are charged to expense first, while the newest and most expensive items are retained in stock. The net effect is that your business will maximize the amount of its reported profits. The reverse impact occurs how to create 7 multiple streams of income: new guide 2023 in a deflationary environment (though this is a relatively rare event). Three units costing $5 each were purchased earlier, so we need to remove them from the inventory balance first, whereas the remaining seven units are assigned the cost of $4 each.

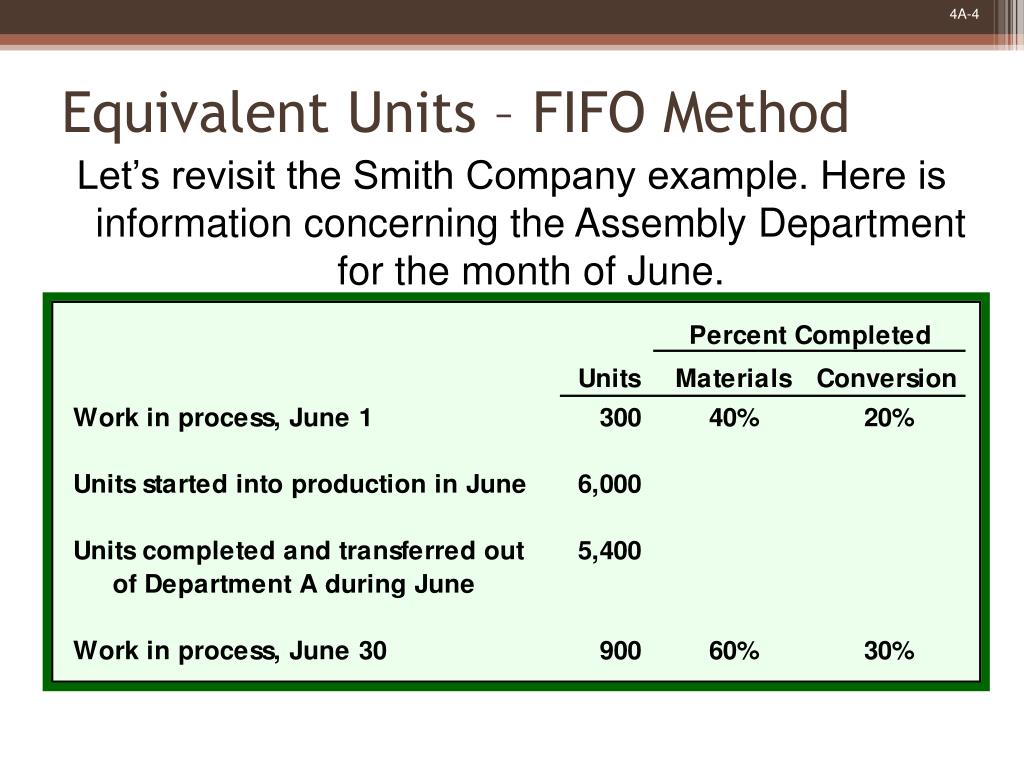

Perpetual Inventory System:

An entry is needed at the time of the sale in order to reduce the balance in the Inventory account and to increase the balance in the Cost of Goods Sold account. But, what if you knew the cost of goods sold and wanted to calculate ending inventory instead? Ending inventory is equal to goods available for sale minus the cost of goods sold. If a physical ending inventory count hasn’t happened yet, a company will use this formula to compute the ending inventory balance. Properly managing inventory can make or break a business, and having insight into your stock through the perpetual inventory method is crucial to success.

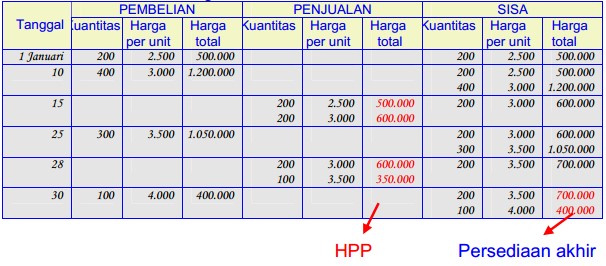

FIFO: Periodic Vs. Perpetual

Specificidentification inventory methods also commonly use a manual form ofthe perpetual system. The Weighted Average Cost (WAC) is the cost flow assumption businesses use to value their inventory. Also called the moving average cost method, accountants perform this differently in a perpetual system as compared to a periodic system. In a perpetual system, the inventory account changes with every transaction. Companies debit their inventory account with the cost of the merchandise each time they purchase or produce inventory and when they sell inventory to customers. The perpetual inventory software updates the inventory account with each transaction.

FIFO Method — First In, First Out

For example, when a retailer purchases merchandise, the retailer debits its Inventory account for the cost. Rather than the Inventory account staying dormant as it did with the periodic system, the Inventory account balance is updated for every purchase and sale. The use of FIFO method is very common to compute cost of goods sold and the ending balance of inventory under both perpetual and periodic inventory systems.

What Are the Other Inventory Valuation Methods?

A company may prefer using a FIFO system when it’s trying to show its largest possible profit on its financial statements for investors, lenders and stakeholders. Let’s say Ava, a product manager, wants to know if she is pricing generic Acetaminophen high enough to leave a healthy profit margin. COGS is an effective formula for setting prices on manufactured goods. If she calculates the COGS as $10 per 100-capsule bottle, she will need to price each bottle higher than $10 so her company can comfortably turn a profit. While there is a constant, automatic product tracking system, there are still ways to lose positive inventory control.

Physical counts to reconcile the database are rare, but necessary, since the true inventory count can become skewed over time with theft, loss or breakage. A typical journal entry would show which account the software debited and which account the software credited for each transaction. As a result, ABC Co’s inventory may be significantly overstated from its market value if LIFO method is used.

However, as we shall see in following sections, inventory is accounted for separately from purchases and sales through a single adjustment at the year end. This method dictates that the last item purchased or acquired is the first item out. This results in deflated net income costs and lower ending balances in inventory in inflationary economies compared to FIFO. There are balance sheet implications between these two valuation methods. More expensive inventory items are usually sold under LIFO so the more expensive inventory items are kept as inventory on the balance sheet under FIFO. Not only is net income often higher under FIFO but inventory is often larger as well.

In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life. Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses. Since 2014, she has helped over one million students succeed in their accounting classes. When doing this by hand, I always cross out the number of units and write in the remaining amount. Keeping track of the number of units remaining will help to ensure that you take your units from the correct date and calculate ending inventory properly. Under FIFO, the value of ending inventory is the same whether you calculate on the periodic basis or the perpetual basis.

The cost of goods sold,inventory, and gross margin shown in Figure 10.15 were determined from the previously-stated data,particular to perpetual FIFO costing. The FIFO reserve, often called the LIFO reserve, keeps track of differences in accounting for inventory when a company utilizes a FIFO method or LIFO method. Sometimes, companies will opt to use FIFO internally because it shows the physical flow of goods.

If we add the cost of goods sold and ending inventory, we get $3,394.00 which is our goods available for sale. The sale on January 31 of 80 units would be taken from the purchase on January 3rd and the purchase on January 12th. Taking all the units from January 3 still leaves us 20 units short of the 245 units we need.